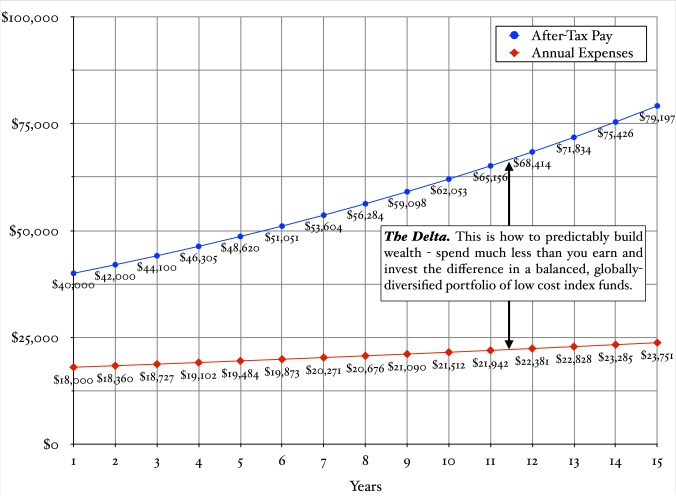

Building wealth is predictable because math is predictable. If you spend what you earn, you’ll never build wealth. But if you spend less than you earn, and save and invest the difference, you’ll build wealth without fail. This is simple stuff, I know – it’s second grade math – but most of us still miss the basic, crucial point that you can only build wealth if your savings rate – the difference between income and expenses – is positive. And the bigger the savings rate, the better.

Knowing your savings rate is essential for two reasons: (1) it dictates how much you can save and invest; and (2) your annual expenses will determine how much you need to reach FI using the 25X rule. And the only way to determine your savings rate is to know how much is coming in (income) and how much is going out (expenses).

Savings Rate: This is how you predictably build wealth.

The Power of Knowing Your Annual Expenses

We all have a good idea of our take home pay – just look at your paycheck. Expenses are a different story. Most of us don’t really know where our money goes each month, but it’s critical that we know and control our expenses in order to reach FI. Here’s an easy spreadsheet approach. Keep all your receipts for the week and go through them on the weekend, noting your daily expenses in a spreadsheet. At the end of the month, itemize your expenses using simple categories such as rent or mortgage, utilities, house expenses, insurance premiums, car payments, gasoline, groceries, childcare, eating out, travel, cable/internet, entertainment, gifts, miscellaneous, etc. Do this for at least a year (preferably forever because things change), but you should get a handle on basic, recurring expenses after a few months.

Figure out your “fixed” expenses such as housing, utilities, gas, groceries, car payment, childcare, insurance premiums, etc. – i.e., your monthly expenses that would take some effort to quickly reduce. Add up all your other expenses as “discretionary”. These are things like eating out, nights out at the bar, going to the movies, vacations, cable TV, buying books, music, clothes, etc. Add them together and compare it to your take home pay. This is your savings rate. Is it a positive or negative number? If it’s positive, great. The bigger the positive savings rate, the better. This is what you save and invest in order to build your portfolio.

Negative Savings Rate?

If your savings rate is negative, there’s work to do. You can either work on your human capital and increase your pay, cut expenses, or both. But cutting expenses is the most practical, immediate solution. Cancel cable and stream t.v. and movies over the Internet. Cook at home and reduce your travel. Sell your house and buy a smaller one or rent a cheaper place. Because if you don’t live comfortably within your means, you will dig a deeper and deeper hole which will eventually consume you, and your net worth will never grow.

Beware of Large, Recurring Expenses

It’s the large recurring expenses that will sink you. While cutting back on occasional items, such as eating out and going to the movies, will help reign in your expenses, it’s more important to avoid the large recurring expenses like buying too much house with all of its ongoing operating costs, buying or leasing expensive cars, private school for the kids, expensive vacations, etc.

Because housing and transportation usually make up the largest percent of recurring expenses, if you live in a small, comfortable place within walking distance to your work, grocery store, library, and local shops and bars, you’ll be light years ahead of your peers, and the cash will really start to pile up. If there’s a sure-fire way to stall and delay FI, it’s buying too much house with a long commute.

Expenses: Through the Investment Income Lens

We should view our recurring monthly expenses through the lens of investment income. For this, we have another handy rule-of-thumb, called the “300X Rule”. This is just the monthly version of the 25X Rule we talked about earlier, because 25 x 12 months/year = 300. It works like this: say you join the Wine of the Month Club for a mere $50/month. This may not seem like much if you compare it to your monthly earned income from your job. But let’s look at it through the investment income lens using the 300X Rule: $50/month x 300 = $15,000. This is how much you need to accumulate in your portfolio in order to pay that $50/month, at a 4% withdrawal rate.

A more powerful example: Sue’s been working for the past 20 years and for the last five has been burned out from job stress. She wants to leave her job, rest for a year, then build a small business for herself. She’s built up $750,000 in investments, but she has 15 more years on her mortgage, which along with taxes, insurance, and upkeep, runs her $2,500/month. Using the 300X Rule, she’ll need $2,500 x 300 = $750,000 in her portfolio just to pay this one recurring expense. But let’s say she sells the house and moves into a nice one-bedroom apartment for $800/month. This only requires $800 x 300 = $240,000. She realizes that she already has enough to cover this, along with her other annual expenses as well. In effect, she’ll reach FI once she sells her house and rents a smaller place. So, she sells her place, leaves work, and decompresses by the apartment pool while planning the next phase of her life.

The Power of Lowering Expenses

Here is the power of lowering your annual expenses: using the 4% Rule, for every $4,000 of annual expenses, you need to save and invest $100,000, making an annualized 7%. So, which is easier:

- Working and saving $100,000, and having the investing knowledge to make a 7% annualized return or;

- Reducing your annual expenses by $4,000?

This is why lowering expenses is so powerful in reaching FI. It’s also the reason why some high earners, such as doctors and lawyers, find it hard to retire. They live large and have huge annual expenses. So, if you’re spending $200,000 a year, you’ll need to save and invest $200,000 x 25 = $5,000,000 before you reach FI. And at a $200,000/year spend rate, not much is left over to save and invest – a vicious cycle.

Don’t Work for Your Assets

Paul Terhorst, author of Cashing in on the American Dream: How to Retire at 35, had it right when he said, “Hard assets create expenses” and “Don’t work for your assets, let your assets work for you.” So don’t work for your assets. Avoid large, recurring expenses as best you can. This will allow your savings rate to remain positive and grow over the years.

Live Modestly and Avoid Lifestyle Inflation

Living modestly means not trying to keep up with those around you – to do so is a FI killer. Be your own person, do your own thing, think for yourself, and ignore what everyone else is doing. Others may brag about their McMansions, new cars, private schools, and exotic vacations, but what you don’t see is their frightening credit card statements, low checking account balance, and an investment portfolio standing at $0. Also hidden is the high anxiety of keeping their expensive lifestyle afloat year after year. A low-key, low-maintenance lifestyle allows you to live on your paycheck with room to spare. The peace of mind that comes with it is priceless. To grow your savings rate over time, avoid increasing your lifestyle each time you get a promotion or a raise. This is called lifestyle inflation, and it, too, is a FI killer. You don’t need to be on Lifestyles of the Rich and Famous to be happy.

This is where reading philosophy will help – Seneca, Lao Tzu, Chomei, Schopenhauer, and Thoreau. Throughout the ages and across cultures, the lesson is the same: curb your desires – appreciate and be content with what you already have. Besides, human beings are wired to be let down and disappointed once we achieve a desire – only to form a new one to chase. The result: an endless cycle of discontentment with constant “if only” thoughts. This may be the most important advice on this site: Once your basic needs are met, and you have a few creature comforts, more and more stuff won’t make you happy. But freedom and autonomy will. If you come to internalize this idea, the resulting frugality coupled with a decent, growing income will result in a massive savings rate.

“Be content with what you have; rejoice in the way things are. When you realize there is nothing lacking, the whole world belongs to you.” Lao Tzu.

Internalize These Concepts

I know this is all easier said than done. There are plenty of reasons why we spend too much and have negative or zero savings rates: hard-wired instincts, personality, family history, unforeseen expenses, status seeking, trying to keep up with our peers, etc., as well as relentless advertising and our consumer culture. These can drag us down into negative savings rate territory if we’re not careful. But if you make FI part of your philosophy of life, growing your savings rate can be a lot of fun. It also becomes easier when you realize what FI can do for you. If you don’t want it in the first place, resisting the urge to buy stuff is no big deal. I can think of no better use of money than to buy freedom and autonomy.

When you internalize these concepts, living modestly is easy and doesn’t feel like a sacrifice. I know that a big house and a lot of stuff won’t make me content, or provide what is really important to me, like tranquility and peace of mind. Today, I feel not envy but sorrow when I see someone buy too much house, pull up in a brand new $60,000 truck, or tell me about their new boat or in-ground pool. They’re drifting further and further away from FI, and they don’t even know it. You’ll automatically make good spending decisions with FI as a guide, and watching your savings rate and investments grow will give you the drive to work on your human capital and live a modest, low-key lifestyle.