In How to Invest – A Primer, we talked about investment risk, where I said “An obvious form of perceived risk is the occasional (and inevitable) stock market decline. This is generally what scares us, but it shouldn’t.” I may have been a bit glib here. It turns out this is exactly what scares most of us, and we can’t help but to worry and lose sleep during market declines. But don’t beat yourself up, it’s human nature. As I write this, the S&P 500 is down about 10% YTD (and it’s only January 17!). Talk of a stock market “contagion” is all over the news, and my friends and family are asking me what they should do. (Short answer: Ignore it and do nothing).

The Bucking Bronco

Given all this, I thought I’d delve a little deeper into the stock market swings that scare all of us.

The stock market is like a bucking bronco, trying to throw us off with market fluctuations. But in order to reap the long-term rewards of investing, we need to hang on during market declines, and to do so, we need to be fully aware of how wild certain asset classes can be en route to potentially generous long-term returns. And we need this awareness before we invest, so it can help us stay the course during the inevitable (sometimes severe) market declines.

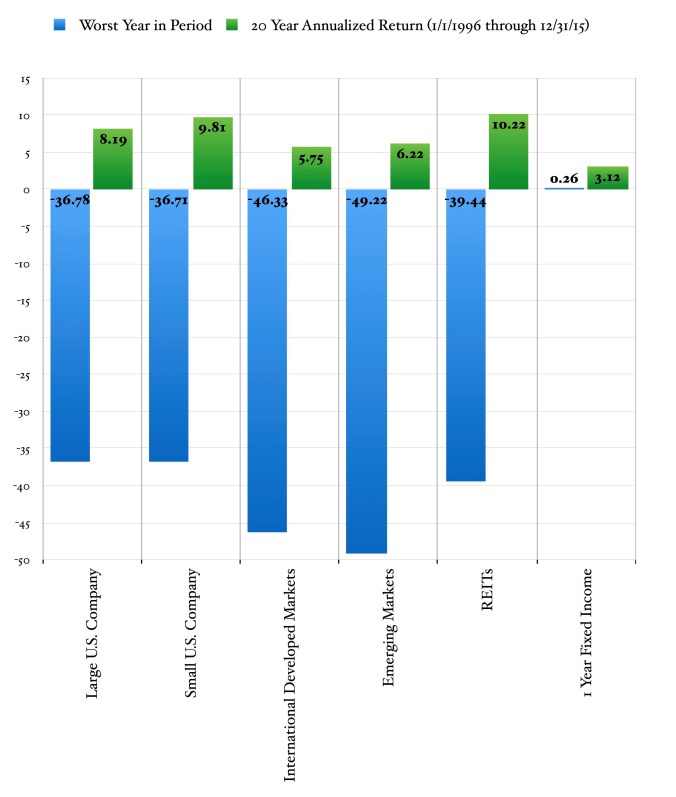

How wild a ride should we expect? The graph below shows the annualized return and worst yearly return for different asset classes for the 20-year period ending December 31, 2015. I chose 20 years because it’s a nice, longish period for stock market investing that also included two brutal bear markets (2000-2002; 2007-2009). What does this graph tell us? At its base level, it’s telling us to be mentally prepared for the occasional wild ride in the stock market, en route to potentially generous long-term annualized returns. This mental preparation is crucial to winning the emotional game of investing and being able to stay the course through market declines.

20-Year Annualized Return Versus Worst Yearly Return for Different Asset Classes. Source: http://www.IFA.com

To illustrate, let’s go through the U.S. Large Company data. First, over this 20-year period, the annualized return was a generous 8.2%. If you invested $10,000 in the market on January 1, 1996 and went to sleep for the next 20 years, you’d have earned the equivalent of 8.2% each and every year, and ended up with $47,480 as your reward for investing in large businesses within the U.S. But, of course, we were all awake during this time, most of us glued to CNBC, Jim Cramer, stock apps on our phones, and Market Watch, with flop sweat on our brows as the market rose and fell en route to that 8.2% annualized return.

During the last 20 years, you’d have needed to endure occasional crushing (but temporary) annual market losses – the worst being a negative 37% during 2008 – en route to an annualized gain of 8.2%. And it’s important to remember that most bear markets span across years, so while the 2008 market return was negative 37%, the peak-to-trough loss, starting in October 2007 and ending March 2009, was negative 55% – a wilder ride than the graph indicates.

What if on January 1, 1996, you invested in 1-Year Fixed Income (think T-Bills)? You’d have turned $10,000 into $18,487: an annualized return of 3.1%. Meanwhile, inflation ate up an annualized 2.3% during this time, so all you really did was preserve the purchasing power of the original $10,000. But the ride sure was smooth. The worst yearly return was 0.26%, with no down years in the 20-year period.

The Final Lesson

If someone promises you high returns with little to no risk, rest assured that they’re a fraud. Potentially high investment returns always come with the very real risk of ferocious losses from time to time. To invest successfully, we need to be mentally prepared for these frightening market losses. Based on the historical data, the losses will only be temporary, but, of course, there’s no guarantee of this as we head into the future. So, from time to time, you will lose money. Sometimes a lot of money. There’s nothing you can do to avoid it. It’s the nature of the market, and we have to learn to live with it.