If you can’t afford to write a check when something bad happens, you’ll need insurance. Some of us complain about paying premiums for insurance that we may never need. Guess what? Consider yourself lucky if you never have to collect. When you do, it means something bad has happened – your house burned down, a car wreck, health problems or an accident, someone died or became disabled. Things you’d rather avoid, I’m sure. Are premiums a waste of money if you never collect on your policy? In most cases, no. The insurance was there if you needed it, helping you avoid financial disaster in case of an accident, health problems, disability, or death.

A Home Warrantee? Nah.

An aside. You don’t need insurance for those things that you can pay for out-of-pocket without inflicting serious financial pain. Do you need to pay premiums year after year on a home warrantee that will replace your furnace if it gives up the ghost? Not really. Just replace the furnace with cash from your rainy day fund. Do you need complete insurance coverage for a used car that you paid $5,000 in cash? Nope, you just need vehicle liability coverage. If you’re paying for your own health insurance, do you need insurance to pay for those $150 cleaning visits to the dentist? No. But you do need health insurance to cover those costs that will ruin you financially. The most important types of insurance such as health and disability have the highest premiums. That’s because while there is a relatively low probability that the insurance will be needed, the cost to the insurance company will be high if it is needed (think catastrophic illness/accident, or long-term disability).

Here are the more common types of insurance we’ll cover, admittedly at a high-level overview: (1) Disability; (2) Life; (3) Health; and (4) Property/Liability. Talk to your insurance agent for details (lots and lots of details).

Disability Insurance – You Get Hurt and Can’t Work

As we discussed in You: A Walking Dollar Sign, your most valuable asset is you, and your long-term earning potential. Yet many of us fail to insure this valuable asset with private disability insurance. This, however, is easier said than done, as the annual premium for private coverage is usually expensive (around 1% – 3% of your annual salary). Again, the reason disability insurance is expensive is the probability of a long-term disability is relatively high – early to middle age, you’re more likely to become disabled than die – as are the costs to the insurance company in the event of a disability.

Don’t think you need disability insurance? Ask yourself these questions. How would you continue to support you and your family if you were disabled and couldn’t work? Who would pay the mortgage, groceries, gas, utilities, school, car payment, etc.? The likely answer is your spouse would have to shoulder the entire financial burden. This is assuming they were working prior to your disability. If not, your spouse probably won’t be able to quickly earn a large enough income. Everything could start to unwind, likely leaving you and your family in dire financial straits. This is why, in a two-income family, it’s best to build your lifestyle around one income as much as possible. If you’re single, disability insurance is even more important, but it becomes less and less so as you move towards financial independence.

Most employers offer group disability insurance that is inexpensive or even paid completely by your employer. Disability insurance usually covers about 60% of pre-tax (i.e., gross) monthly earnings (salary only – excludes bonuses, deferred compensation, etc.). Make sure you max out this coverage. Your group disability is connected to your job, however, so if you quit, your disability insurance goes away.

Life Insurance – You Die and Can’t Work

Does your paycheck provide for kids and/or a spouse? Would they be in financial trouble without your support? If so, you’ll need life insurance to replace your income in the event that you die. But if no one (i.e., spouse and/or kids) is dependent on your income, then you do not need life insurance, either term or permanent. Don’t ever buy life insurance as an investment – only buy it if you need insurance to support dependents should you die.

Generally, the amount of life insurance that you’ll need is based on an evaluation of a number of factors such as your income, spouse’s income, number and age of kids, overall lifestyle and annual expenses, among a few. Your life insurance agent (or on-line calculator) can run these numbers for you and come up with a reasonable estimate. For most standard families, as a general rule-of-thumb, you’ll need life insurance benefits of about ten times your gross annual salary. Note that life insurance payouts are income-tax free.

For most of us, a term life insurance policy is all we need. With term life insurance, you pay premiums during the term of the policy, say 20 years. If you die during the term period, the insurance company pays the benefit. If not, the term insurance expires and you’re out your premiums. If you decide to renew your term insurance at that time, however, you’ll be paying higher premiums because you’re now older and more likely to die within the renewed term period.

The advantage of term insurance is it’s affordable because the probability of dying in early to middle age is relatively low. Most of us only need life insurance for a set period of time anyway – say during our peak earning years when our kids are still young. Once the kids are grown up and on their own, and your pension or retirement income kicks in, you don’t need life insurance.

Unless you really need life insurance in your later years – for example, to support an adult special needs child – avoid whole (“permanent”) life insurance, and its cousins universal life and variable life. As with most complicated financial products, these policies are loaded with commissions, fees, and expenses that only benefit the insurance company, and the cash value accumulates slowly due to all the headwinds to growth. That’s why these policies are usually sold to an unsuspecting public, rather than being sought out.

Health Insurance – We All Need at Least Catastrophic

We all need at least catastrophic health insurance (i.e., you get hit by a bus or get really sick). While many of us are covered by our employer, those of us setting out on our own or wanting to quit work early will need to get coverage through the Patient Protection and Affordable Care Act (ACA) insurance exchanges. I’ll provide a brief summary of the ACA, but if you want to know more head over to http://www.healthcare.gov for details.

To start, the ACA knocked down an obstacle to those of us looking to retire early or wanting to start our own business, because we now have viable, affordable options. Lack of affordable, private health insurance was once a deal breaker for early retirement or lighting out on your own, but no longer. The two key ACA items are: (1) guaranteed issue and; (2) subsidies for insurance premiums and annual out-of-pocket costs.

Guaranteed issue – You cannot be turned down due to a pre-existing condition, nor can your health insurance exclude coverage of pre-existing conditions. And there’s no annual limits on essential health benefits, and no lifetime caps.

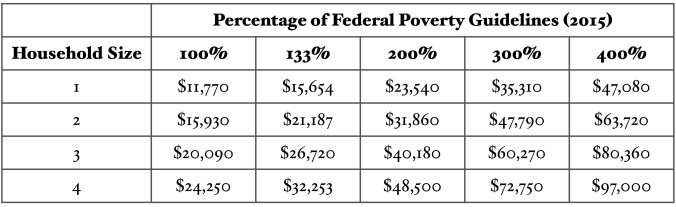

Subsidized premiums and annual out-of-pocket costs – Both premiums and annual out-of-pocket costs are subsidized if your income falls within 400% of the Federal poverty level. See the table below. The Modified Adjusted Gross Income (MAGI), which is just AGI with a few tweaks for a few uncommon items, is used to determine eligibility and premium credit amounts. So the income amount on the following tables is essentially your household AGI, not gross income.

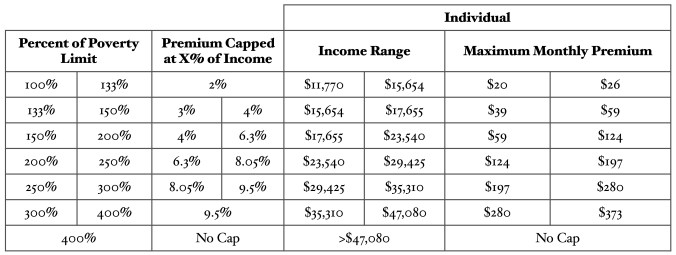

If your income is below 400% of the poverty level, your premiums are capped based on a sliding scale that starts at 2% of gross income at the 100% to 133% of poverty limit range, and tops out at 9.5% of gross income in the 300% to 400% of poverty limit range. Because your premiums are capped at a certain percent of income, regardless of age, your premiums will not skyrocket as you get older, as they did in the past. If your income is below 133% of the poverty level, you’ll generally qualify for free health insurance through your state’s Medicaid program, since the ACA also expanded these state programs.

Once your income reaches even one dollar above the 400% limit, your subsidy immediately goes to zero, so it’s critical to keep your income below this amount if you want to qualify for subsidies. Here’s how to calculate your premium using the sliding scale. The table below shows the sliding premium scale for an individual (using 2015 limits). For example, if you make $23,540/year (this is adjusted gross income, or AGI), your premium will be capped at 6.3% of AGI, and your maximum monthly premium would be $124. The Premium Credit is tied to the Second Lowest Cost Silver Plan (SLCSP).

Your annual out-of-pocket costs do not include the cost of your premiums. Out-of-pocket costs are what you pay for actual health care during the year: doctor visits, tests, hospital stays, prescription drugs, co-pays, etc. If you don’t visit a doctor, have no hospital stays, and don’t take medication, your out-of-pocket would be zero for the year.

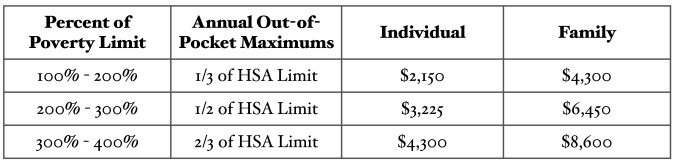

Under the ACA, annual out-of-pocket costs are capped at $6,450 for individuals and $12,900 for a family (these are taken from Health Savings Account [HSA] limits). Once this cap is reached, your plan will pay for all covered expenses for the rest of the year. Note that these caps are the unsubsidized maximum that any individual or family would have to pay each year, regardless of income (even above 400% of the poverty level). For those of us with incomes below the 400% poverty level, the out-of-pocket maximum is subsidized, as shown in the table below (using 2015 HSA limits).

For example, your maximum annual out-of-pocket cost would be $3,225 if your AGI was between 200% and 300% of the poverty limit. Again, the subsidy immediately drops to zero if you’re even one dollar above the 400% limit. But remember that even if your income is above the 400% limit, your annual out-of-pocket cost will still be capped at $6,450 for an individual and $12,900 for a family.

The health insurance exchanges offer four different types of plans – Bronze, Silver, Gold, and Platinum – offering different blends between monthly premium amounts and out-of-pocket expenses. The Platinum plan has the highest monthly premiums, but the lowest out-of-pocket expenses, while the Bronze plan offers the lowest monthly premiums, with higher out-of-pocket costs. Note, however, that the Bronze plan does not include a subsidy for out-of-pocket costs (the annual out-of-pocket cap still applies, though).

The Silver plan is the baseline model, and offers a nice balance between monthly premiums and out-of-pocket costs, both of which are subsidized in this plan, as long as your income remains below 400% of the poverty limit.

So the health insurance landscape has certainly changed for the better for those of us wanting to start our own business or retire early. But remember, as important as it is to have health insurance, much of your health is up to you, and your best insurance is to take care of yourself and prevent health problems as best you can. It doesn’t take much, and there are quite a few things in your control that will help – avoid processed foods, sugar, and easily digestible carbohydrates (anything made with flour or starch), exercise every day, get 8 hours of sleep each night, from 10 pm to 6 am, go with the flow and keep your stress level low, drink booze in moderation, minimize screen time, surround yourself with good friends and family, and have something that gets you out of bed in the morning.

Property and Liability Insurance – If Things Go Sideways

Homeowner’s insurance covers property loss in the event your house is damaged or destroyed by fire or certain natural disasters, as well as loss from theft. Auto insurance covers loss of your car (if you have collision coverage), the other car (if it’s your fault), and liability in case of injury to another party. If you’re injured, your health insurance will cover you, not your auto liability insurance. Both home and auto include some type of liability insurance. An umbrella liability coverage above and beyond home and auto liability would provide additional protection for nearly any scenario where you could be sued for non-professional liability. Relative to the liability protection you receive, it’s cheap. Maybe around $400/year for $1,000,000 umbrella coverage. Aim for enough umbrella liability insurance to cover the difference between basic liability coverage (from your home/auto insurance) and your net worth.

So, where does this leave us?

- At a minimum, max out the disability insurance offered by your employer. If you’re married and you both work, try to build your lifestyle around only one income, so the need for disability insurance is less critical.

- If your spouse and/or kids depend on your paycheck, buy term life insurance. Unless you have a special-needs child or need it for estate planning reasons, avoid permanent life insurance. And if you have no dependents, you don’t need life insurance at all.

- All of us need at least a high-deductible, catastrophic health insurance policy, so we can afford the premiums, maintain coverage, and protect ourselves against catastrophic losses in case of health problems or an accident. Decent, affordable health insurance is now a reality thanks to the ACA.

- Work with your agent to determine the optimal amount of property and liability insurance. The key is to balance premiums with coverage, with the goal of avoiding serious out-of-pocket financial pain should you have a property loss or are sued for liability. I also recommend an umbrella liability policy, especially for those of you with a high net worth.

- Notice that the more complicated your life, the more insurance you’ll need. My life is admittedly about as simple as it gets. I’m single, no kids (lots of nieces and nephews, though), don’t own a house, and have a 2003 two-seater truck. So the only insurance I carry is high-deductible health insurance and vehicle liability insurance. That’s it. Of course, many of us want to build our lives around getting married, having kids, and raising a family, with more responsibilities, dependents, bigger houses, and more cars to go along with it. Just keep in mind that your insurance needs – and costs – will be commensurately higher.