In order to reach FI, you need to do three things: (1) build your human capital to power your finances; (2) keep expenses modest; and (3) invest wisely. All of these play an equally important role in building your investment portfolio and reaching FI, and you need to do all three to succeed. While most of us have an intuitive understanding of the first two, investing seems to be a real mystery. But once explained, it’s simple to grasp how the capital markets and investing work.

These next few posts will be a little more technical and detailed than the others, but it is vital that you absorb this information. It will provide you with the knowledge, insight, and motivation required for successful investing. For example, during a down market, you need to be able to say “I’ve seen this movie before and I know how it ends” and act accordingly, which in almost all cases is to stay calm and do nothing.

Investment Return = Yield + Capital Gain

At its most basic level, over the long term, stock market returns are driven by dividends and corporate earnings growth for U.S. and international companies. Earnings are a company’s profits and a dividend is an annual payment to shareholders paid from those profits. Over time, a growing stream of profits will push the stock share price higher, simply because a company becomes more valuable as its profits grow. The total return for a stock is just the dividend plus the stock price increase (i.e., yield + growth). Bond returns are driven by interest rates: the bond yield at the time of purchase plus or minus the change in bond price if interest rates change (the bond price will decline if interest rates rise, and vice versa). So again, total return = yield + growth. These are the basic fundamentals.

Think Decades

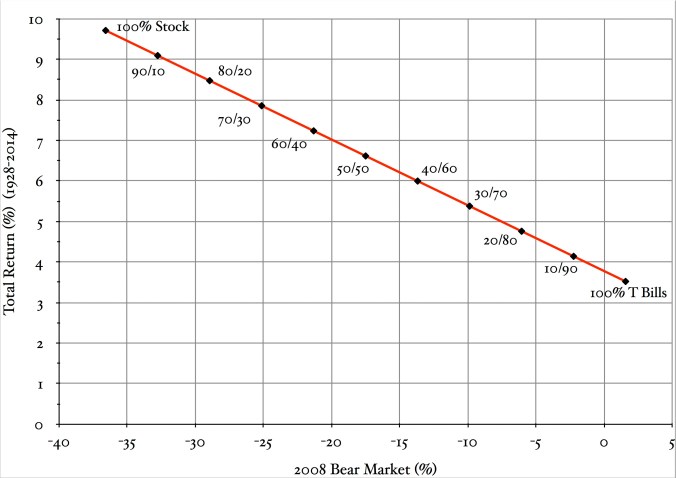

True investing is holding stocks and bonds for the long term – think decades. Trying to make money on short-term changes in stock prices, holding stocks over short time periods, market timing, etc. is not investing, it’s speculating, which will eventually bury you. Even true investing – holding a balanced portfolio of stocks and bonds for the long term – does still carry risk, of course. But if there is one consistent truth to investing, it is this: risk and investment return go hand in hand. If you want relatively high long-term returns, you must take risks with your capital. Otherwise, expect low returns. It can’t be any other way.

Be Forewarned

Over the long term you will very likely be rewarded for investing in stocks, but you will lose money along the way. It’s inevitable. And sometimes you’ll lose a lot of money. But based on the past 150+ years of stock market data, these losses will only be temporary. If you can hold on and do nothing, so long as the world economy continues to grow, your holdings will again start to grow in value and eventually climb to new highs (and throw off dividends along the way, to boot). But beware: while most market declines recover in a matter of days, weeks, or months, sometimes “temporary” can be up to 3 to 5 years before the market recovers, maybe more if the market decline was severe.

The relationship of risk versus return. An all-stock portfolio returned an annualized 9.7% from 1928 through 2014, but suffered great temporary losses along the way, such as a -36.5% return during 2008. An all-T bill portfolio fared well during 2008, but with a corresponding low long-term annualized return of about 3.5%. Want high returns over the long term? You must be able to weather frightening down markets along the way. Source: Standard & Poor’s; St. Louis Federal Reserve.

An Act of Faith

Investing is an act of faith, and risk is investing in the face of uncertainty about the future. One form of perceived risk is the occasional (and inevitable) stock market decline. This is generally what scares us, but it shouldn’t. As I mentioned above, based on the 150+ years of investment history, bear markets have always been followed by bull markets. The temporary losses are recovered, and positive gains then follow. Since 1926, the average recovery period of bear markets has been 3.3 years (adjusted for dividends and inflation, the average bear market decline during this period was about 30%). It took five years to recover from the bear market of 2007-2009, when prices fell by 55% peak-to-trough. Again, take a “decades” approach to investing, not daily or weekly, or even yearly.

A Cork on the Sea

Our behavior, of course, can result in risk when, spooked by a market decline, we sell at the market bottom. But this risk can be avoided by ignoring the market’s ups and downs as best you can, and simply do nothing. Think of yourself as a cork on the sea, bobbing up and down with the market. It’s comforting to invest this way (i.e., just set and forget your investments) because you don’t need to constantly fret about the market or worry about the need to make investment decisions day after day.

Risk Is Rewarded

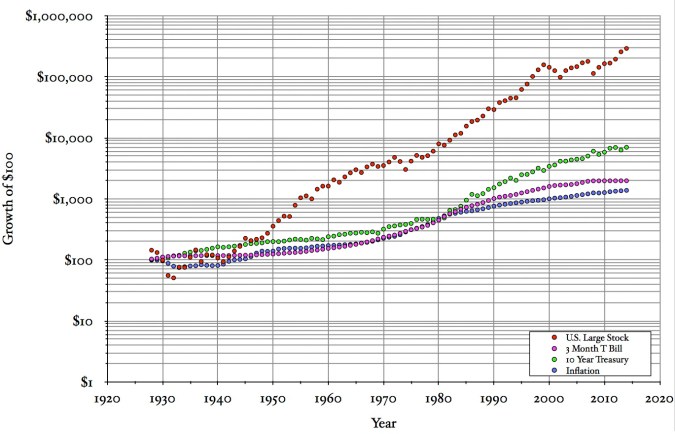

Based on historical returns, risk has been rewarded. It has to, really. Because if CDs or short-term bonds had the same expected long-term return than stocks, who would buy stocks? No one – and that is the reason why stocks need to provide the possibility of long-term returns that are higher than bonds and cash. There is no guarantee, however, that this will happen, certainly not for individual stocks.

Long-term growth of $100 from 1928 through 2014 for large cap stocks, bonds, bills, and inflation. This graph shows the long-term advantage of investing in business, where goods and services are created and sold to generate and grow earnings. This graph can be misleading though – most of us don’t have an 80+ year investing time horizon. Sources: Kenneth French; St. Louis Federal Reserve; inflationdata.com.

But Only Over the Long Term

Risk versus return reveals itself over the long term: the annualized rate of return from 1928 through 2014 was 12.2% for U.S. small company stocks, 9.7% for U.S. large company stocks, 5.1% for Treasury bonds, and 3.5% for Treasury bills. Inflation averaged about 3% during this period. The extra return above the risk-free rate of return of Treasury bills is called the equity risk premium and is your reward for taking risk with your capital and investing in global businesses, both large and small. But there have been long stretches of time (10 to 15 years) when stocks underperformed bonds, usually after a long bull market that raced ahead of business fundamentals, effectively borrowing from the future. Think about the 10-year return from 2000 through 2009 (roughly -1% annualized) which followed 20 years with an annualized return of about 17% (1980 through 1999).

For Two Minutes of Work

Let’s now turn our attention to investing in the stock market. As we do, keep in mind that investing in stocks is not about owning pieces of paper to frantically trade back and forth. It’s about being a long-term, part-owner of businesses in the U.S. and across the globe. If you do it right, you’ll be part-owner of every publicly traded company in the world. And it’ll take you just two minutes of work.